In today’s financial landscape, having a good CIBIL score is essential, especially in India, where a credit score can make or break your chances of securing loans, credit cards, or even a good job. But what exactly is a CIBIL score, and why is it crucial to maintain a healthy one?

More importantly, how to improve CIBIL score in India if yours is not up to the mark? This article will cover the basics, importance, and practical steps to improve your CIBIL score and maintain it.

What is a CIBIL Score?

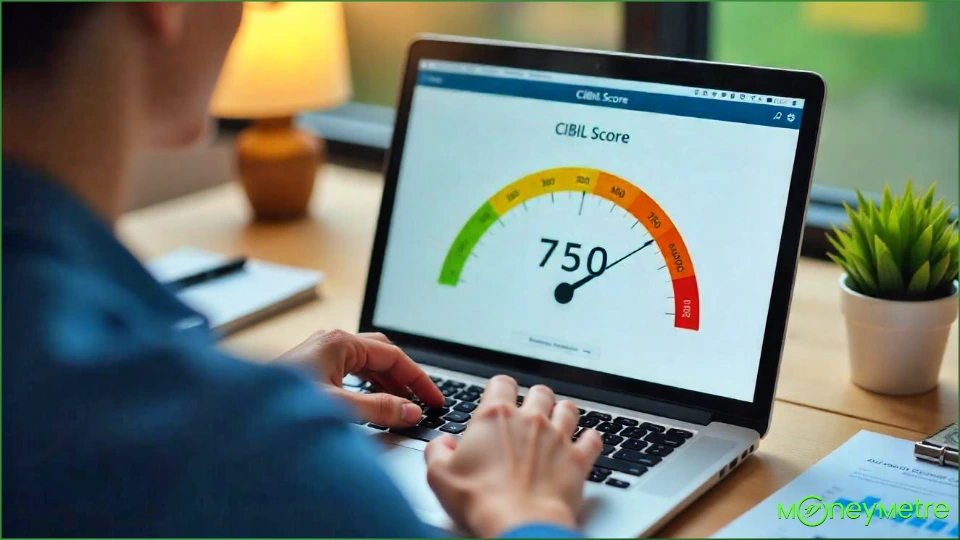

A CIBIL score is a three-digit credit score, ranging from 300 to 900, calculated by TransUnion CIBIL, one of the leading credit bureaus in India. This score reflects your credit history, including your ability to repay loans, credit card usage, and overall financial discipline. A higher score indicates that you are a responsible borrower, making you more likely to get loans and credit approvals.

Why is it Important to Improve Your CIBIL Score?

- Loan Approvals: Banks and financial institutions rely heavily on CIBIL scores when deciding to approve or reject loan applications. Higher scores (750 or above) make you a preferred customer.

- Lower Interest Rates: Borrowers with higher credit scores often get loans at lower interest rates, saving significant money over time.

- Higher Credit Limits: A good CIBIL score often translates to higher credit limits on your credit cards, allowing more financial flexibility.

- Employment Opportunities: Many employers in India, especially in the financial sector, consider credit scores when hiring for roles that require financial trust.

Clearly, a strong CIBIL score is a gateway to financial benefits and a safety net for your future. Now, let’s explore how to improve CIBIL score in India if your current score needs a boost.

10 ways to Improve Your CIBIL Score in India

1. Check Your CIBIL Score Regularly

Start by checking your CIBIL score regularly. This can be done through the official CIBIL website. Reviewing your score will help you understand where you stand and identify errors or discrepancies in your credit report. Checking your score does not negatively impact it, so make it a habit.

2. Correct Any Errors in Your Credit Report

Errors in your credit report can lower your CIBIL score. Common errors may include incorrect personal information, wrong credit balance, or even loans and credit accounts you did not open. Dispute these errors by contacting CIBIL via their dispute resolution page and provide the necessary documents for correction.

3. Pay Your Bills on Time

Timely payments are crucial for a good CIBIL score. Ensure you pay your EMIs, credit card dues, and utility bills on or before the due date every month. Even one late payment can negatively impact your score. Setting reminders or automating payments can help you stay consistent with on-time payments.

4. Reduce Your Credit Utilization Ratio

The credit utilization ratio is the percentage of available credit that you are currently using. Ideally, you should use less than 30% of your total credit limit. For instance, if your credit card limit is ₹1,00,000, try to keep your monthly usage under ₹30,000.

If you constantly use close to your limit, it can negatively impact your score. Try requesting a credit limit increase from your bank or reducing your spending to maintain a low utilization ratio.

5. Avoid Multiple Loan or Credit Card Applications

When you apply for multiple loans or credit cards simultaneously, lenders see you as “credit-hungry,” which can lower your score. Each application creates a “hard inquiry” on your credit report, which can hurt your CIBIL score. Therefore, apply for credit only when necessary and avoid frequent applications.

6. Keep Old Credit Accounts Open

Closing old credit accounts may seem like a good idea, but it can shorten your credit history, which is a key factor in your score. Longer credit histories with timely payments show lenders that you are a responsible borrower. So, if you don’t have a specific reason to close an old account, keep it open and use it occasionally.

7. Diversify Your Credit Portfolio

A balanced credit mix of secured loans (like home or auto loans) and unsecured loans (like personal loans and credit cards) can improve your CIBIL score. Lenders view a diverse credit portfolio positively as it demonstrates your ability to handle different types of credit responsibly.

8. Don’t Become a Loan Guarantor Without Consideration

If you become a guarantor for someone else’s loan, it can affect your CIBIL score if they fail to make timely repayments. Ensure you fully understand the responsibilities before becoming a guarantor, as it could impact your creditworthiness.

9. Repay Your Loans Strategically

If you have multiple loans, prioritize repaying those with higher interest rates or shorter terms. Repaying high-interest loans first can relieve financial pressure, and completing loan repayments positively impacts your CIBIL score. Avoid defaulting or settling loans with banks, as “settled” status is less favorable than “closed” in your credit history.

10. Monitor Joint Accounts Regularly

If you have a joint account or a loan with someone else, monitor it closely. Any missed payment from the co-owner will impact your CIBIL score as well. Make sure that both parties stay financially disciplined to avoid potential impacts on your score.

Conclusion

Improving your CIBIL score in India is not an overnight task but a journey that requires consistent and mindful financial habits. By regularly checking your score, paying bills on time, maintaining a low credit utilization ratio, and avoiding frequent loan applications, you can steadily increase your CIBIL score.

A high CIBIL score is a valuable asset that can unlock financial opportunities, reduce borrowing costs, and improve your overall financial well-being.

Following these steps, anyone can effectively learn how to improve CIBIL score in India and secure a brighter financial future. So, take charge of your financial health today and work toward a strong credit score that will benefit you in the long run.

Read Also: How to Improve CIBIL Score Using Credit Card: 7 Essential Tips

FAQs on “How to Improve CIBIL Score in India?”

-

What is a good CIBIL score for loan approval in India?

Generally, a CIBIL score above 750 is considered good and increases your chances of loan approval.

-

How long does it take to improve a CIBIL score?

Improving your CIBIL score can take a few months to a year, depending on your financial behavior.

-

Can I improve my CIBIL score by paying only the minimum on my credit card?

No, paying only the minimum due can increase your credit utilization ratio, negatively affecting your CIBIL score.

-

Does checking my CIBIL score reduce it?

No, checking your own CIBIL score is considered a soft inquiry and does not impact your score.

-

How do late payments affect my CIBIL score?

Late payments can significantly reduce your score, as payment history is a major factor in determining your CIBIL score.

-

Is a secured credit card a good way to build a CIBIL score?

Yes, using a secured credit card responsibly is a good way to build or improve your CIBIL score.

Read Other Latest Posts Below