Index funds are a type of investment where your money is used to buy a group of shares from different companies. Think of it like a basket that holds many different fruits. Instead of buying one fruit (or one company’s shares), you are buying the whole basket, which has small parts of many companies.

These funds follow a list, or index, like the Nifty 50 or Sensex in India. These lists include the biggest companies in the stock market. When you invest in an index fund, you’re putting your money in all the companies listed in that index. In this article, you will learn about index funds and how to invest in index funds for beginners.

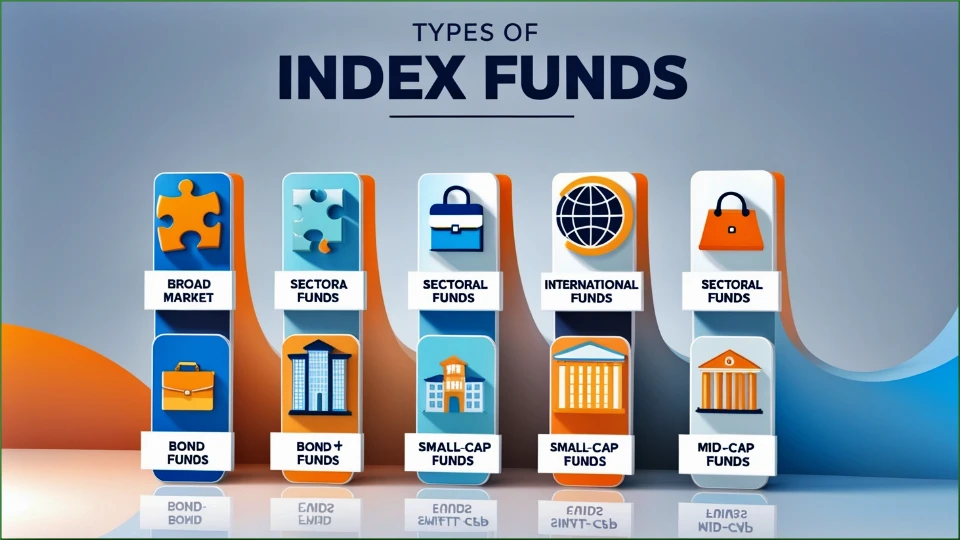

Types of index funds

There are different types of index funds, and each one follows a specific group of companies or sectors.

Let’s break it down in very simple language:

Broad market index funds

These funds invest in many companies across the whole stock market. They follow popular indexes like Nifty 50 or Sensex, which include the biggest and best companies in the country. It’s like buying a mix of the top companies in the market.

Sectoral index funds

These funds invest in companies from just one sector or industry. For example, there are index funds for banks, technology companies, or healthcare. It’s like buying fruits from one type of tree, like only apples, instead of a whole mix.

International index funds

These funds invest in companies from other countries, not just your own. It’s like putting your money in the biggest companies around the world, not just in India.

Bond index funds

Instead of investing in companies (stocks), these funds invest in bonds. Bonds are like loans you give to the government or companies, and they pay you interest. It’s a safer option compared to stocks.

Small-cap and mid-cap index funds

These funds invest in smaller or medium-sized companies that are not as big as those in the Nifty 50 or Sensex. These can grow quickly but are also riskier. It’s like planting seeds that could become big trees, but it might take time and care.

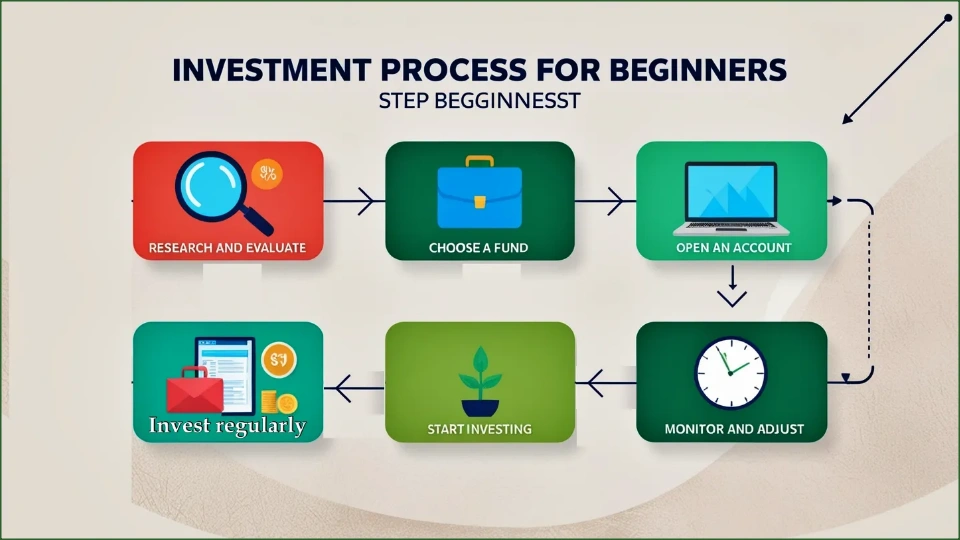

How to invest in index funds for beginners?

We are providing a simple process for beginners to invest in index funds, follow these steps—

Choose a good index fund

First, you need to find an index fund to invest in. An index fund is a type of mutual fund1 that follows a specific list of top companies, like Nifty 50 or Sensex.

You can look for index funds by checking with banks, investment companies, or online apps that help you invest. Pick a fund that follows a well-known list (index) and has a good track record.

Open an account

To invest in an index fund, you will need to open a Demat account or an investment account. You can do this by visiting a bank, talking to an investment advisor, or using a mobile app for investing. They will ask for some simple details like your ID proof, address proof, and a bank account to transfer money for investment.

Decide how much money to invest

Start with an amount that you are comfortable with. You don’t need a lot of money to start investing. Some index funds let you begin with as little as ₹1000 to ₹5000.

Start your investment

Once your account is ready, you can buy units of the index funds. The money you invest will be spread across all the companies in the index. For example, if you invest in a Nifty 50 index fund, your money will go into all 50 companies listed in the Nifty 50 index.

Invest regularly

It’s a good idea to invest a small amount regularly (every month). This is called SIP (Systematic Investment Plan). It helps you grow your money slowly and steadily, without worrying about market ups and downs.

Stay patient

After investing, let your money grow. You don’t need to check the market every day. Index funds usually grow over time, so staying invested for a long period (a few years or more) will help you earn more.

How to select the right index fund?

To select the right index fund, simply follow these steps—

Choose a fund that matches a popular index

Pick a fund that tracks a popular index like Nifty 50 or Sensex. These are the most trusted indexes and have big, well-performing companies. It’s safer to invest in these.

Look at the fund’s past performance

Check how the index fund has done in the past few years. If it has given steady and good returns, it could be a good choice. You can ask the bank or investment company to show you this information.

Check the fund’s cost (Expense ratio)

Every index fund charges a small fee for managing your money. This is called the expense ratio. Look for a fund with low fees because high fees reduce your profit. Lower fees means you get to keep more of your money.

Go with a reputable fund company

Choose an index fund from a trusted investment company like SBI, HDFC, or ICICI. These are big companies that many people trust, so your money will be safer with them.

Consider how long you want to invest

If you plan to invest for a long time (like 5 or more years), pick a stable index fund that will grow slowly but steadily. Don’t worry if the market goes up and down in the short term.

Ask for help

If you are unsure, it’s always good to ask a financial advisor or someone who knows about investments. They can help guide you to the best index fund for your needs.

How to invest in index funds in India – Stepwise process

Investing in index funds in India is simple and easy. Here’s a step-by-step guide in very basic terms to help anyone understand the process:

1. Open a Demat Account

First, you need to have a Demat account. It’s like a bank account but for buying and selling investments (like shares and mutual funds). You can open this account at any bank or financial company (like SBI, HDFC, ICICI, or Zerodha).

Steps to open a Demat account:

- Visit a bank or financial company.

- Fill out a form with your details.

- Provide an Aadhaar card, PAN card, and some other ID proof.

- After verifying your details, your Demat account will be opened.

2. Choose a reliable broker or investment platform

To buy index funds, you need to use a broker or an investment app. This is the platform where you buy and manage your investments. Popular apps in India are Zerodha, Groww, Paytm Money, or you can use your bank’s investment service.

3. Research and select an index fund

Now, you have to choose which index fund you want to invest in. Some popular index funds in India follow Nifty 50 or Sensex (these are groups of top companies in the stock market).

How to choose an index fund:

- Look for Nifty 50 Index Fund or Sensex Index Fund.

- Check the fund’s performance, fees, and the company managing it (like SBI, HDFC, or ICICI).

- You can read about the fund on investment apps or websites.

4. Decide how much you want to invest

Once you select an index fund, decide how much money you want to invest. Some funds let you start with as little as ₹500 or ₹1,000.

5. Make the investment

After selecting the fund and deciding how much to invest, follow these simple steps:

- Log into your investment app or ask your broker to buy the index fund for you.

- Select the fund you chose (like Nifty 50 or Sensex).

- Enter the amount you want to invest.

- Click on Buy or Invest.

6. Choose between one-time or SIP

You can invest in two ways:

- One-time investment: You invest all your money at once.

- SIP (Systematic Investment Plan): You invest a fixed amount (like ₹500 or ₹1,000) every month. SIP is good for long-term growth.

7. Track your investment

After investing, you can check how your money is growing by logging in to your investment app. You don’t need to check daily, but it’s good to look at your investment every few months.

8. Stay invested for the long term

To get the best returns from an index fund, it’s good to stay invested for a long time (5 years or more). Don’t panic if the market goes down for a short time—your investment will grow over time.

Advantages and disadvantages of index funds

We have explained the advantages and disadvantages of index funds in very simple language.

Advantages of index funds

1. Easy to Understand: Index funds are simple. They invest in a group of top companies (like Nifty 50 or Sensex). You don’t need to worry about picking individual stocks.

2. Low Cost: Index funds have low fees because they don’t need a manager to decide which stocks to buy. They just copy the index (Nifty or Sensex).

3. Diversification: Your money is spread across many companies in the index, which reduces risk. If one company does badly, others might still do well, balancing things out.

4. Good for Long-Term Investment: Index funds usually grow over time, so they are good for long-term investment (5 years or more). Your money can grow steadily.

5. Less Risk: Since index funds invest in big, well-known companies, they are usually less risky than investing in individual stocks.

Disadvantages of index funds

1. No Big Profits Quickly: Index funds grow slowly over time. If you are looking to make quick, big profits, this may not be the right choice.

2. Cannot Beat the Market: Index funds only follow the market. They won’t give higher returns than the stock market. If the market goes down, the index fund also goes down.

3. Less Control: You don’t get to choose which companies to invest in. The fund automatically follows the index, so you can’t remove bad companies.

4. Market-Dependent: Index funds are tied to the stock market. If the market falls, your index fund will also lose value. You have to be patient and wait for the market to recover.

Our Suggestions

If you are new to investing in index funds, start by putting in a small amount of money that you can easily afford. Look for funds that follow popular indexes like Nifty or Sensex. It’s a good idea to invest a little bit every month to grow your money over time.

Be patient because index funds take time to grow, so don’t rush to sell them. Lastly, keep learning about investing and the stock market to help you make good choices.

Conclusion

We can say index funds are a smart way to invest your money because they are simple, low-cost, and can help you grow your wealth over time.

By investing in a mix of top companies, you reduce risk and make your money work for you without needing to pick individual stocks.

Remember to start small, invest regularly, and be patient. If you keep learning and stay committed, index funds can be a great option for your financial future.

Read Also: What is the difference between intraday and long term trading?

Read Other Latest Posts Below