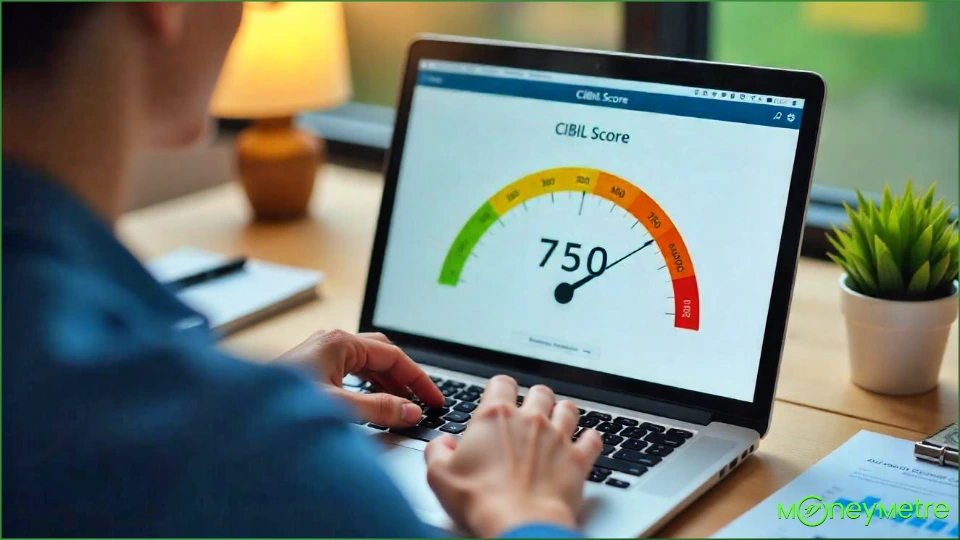

A CIBIL score is a credit score used in India to assess an individual’s creditworthiness. It is a three-digit number ranging from 300 to 900, where a higher score indicates better credit health.

For Indian individuals looking to secure loans, get credit cards, or improve their financial standing, understanding how much time it takes to improve a CIBIL score is essential.

Improving your CIBIL score can significantly impact your financial opportunities, as a high score opens doors to better interest rates, higher credit limits, and overall financial freedom.

Let’s explore what a CIBIL score is, why it is crucial, and how you can improve it effectively. Finally, we’ll cover how much time it takes to improve CIBIL score and provide tips for a faster path to a higher score.

What Is a CIBIL Score and Why Is It Important?

The CIBIL score (maintained by TransUnion CIBIL) is a numerical summary of your credit history, which banks and lenders use to gauge your ability to repay loans.

It is based on a range of factors like repayment history, credit mix, length of credit history, and credit inquiries. Here’s why it is vital:

- Loan Approval: A higher CIBIL score can improve your chances of getting loans, while a low score might result in rejection.

- Better Interest Rates: Lenders offer better interest rates to borrowers with a good credit score.

- Credit Card Benefits: With a higher CIBIL score, you may enjoy better credit card benefits, such as higher limits and rewards.

- Faster Loan Processing: With a high score, loan processing is usually faster, as lenders perceive you as a low-risk borrower.

Having a good CIBIL score (typically above 750) is essential for anyone planning to take a loan or use credit in India. Therefore, improving the CIBIL score should be a priority if you have a low score.

Why Improving CIBIL Score Is Necessary for Everyone?

A low CIBIL score can limit your access to financial products and may cause delays in approval or higher interest rates on loans. Even if you don’t need a loan immediately, building a good credit score can help you in times of emergency or when you need funds urgently.

A low score can lead to higher costs and less favorable terms with lenders, which can be financially draining in the long run. For these reasons, every individual should aim to improve and maintain a healthy CIBIL score.

How Much Time It Takes to Improve CIBIL Score?

One of the most common questions asked by those looking to repair their credit is, “How much time it takes to improve CIBIL score?” This depends on the current state of your credit history, your financial discipline, and the changes you make to your credit behavior.

Generally, it can take anywhere from 3 to 12 months to see a significant improvement in your CIBIL score. Here’s a breakdown of how various actions can impact the timeline:

1. Paying Off Outstanding Debts

- Time to impact: 3 to 6 months

- Paying off your outstanding credit card bills and loans on time can lead to a gradual increase in your CIBIL score. Timely repayments help build a positive credit history, which reflects well on your score. Late payments, on the other hand, negatively impact your score.

2. Reducing Credit Utilization Ratio

- Time to impact: 1 to 3 months

- Your credit utilization ratio is the percentage of credit limit used. For instance, if you have a credit card limit of ₹1,00,000 and use ₹30,000, your utilization ratio is 30%. A lower ratio (ideally below 30%) is favorable. By paying down balances and maintaining low usage, you can see your CIBIL score improve within a few months.

3. Avoiding Multiple Loan Inquiries

- Time to impact: Immediate to 6 months

- Applying for multiple loans or credit cards within a short span can lower your score. Each inquiry by a lender, called a “hard inquiry,” slightly reduces your score. Limiting credit inquiries can prevent further drops, and after 6 months, the impact of past inquiries begins to lessen.

4. Correcting Errors in Your Credit Report

- Time to impact: 1 to 2 months

- Errors in your credit report, like incorrect loan amounts, wrong dates, or inaccurately reported defaults, can negatively affect your score. You can dispute errors on your credit report by contacting CIBIL directly or by visiting TransUnion CIBIL’s dispute resolution page. Once corrected, these changes can have a quick positive effect on your score.

5. Diversifying Your Credit Mix

- Time to impact: 6 to 12 months

- Having a good mix of credit types (e.g., credit cards, personal loans, home loans) can benefit your score. If you only use credit cards, adding a small personal loan and managing it responsibly can improve your score, though this typically takes longer to reflect.

6. Maintaining Consistent Payment Behavior

- Time to impact: Ongoing (6 to 12 months)

- Consistently paying bills on time, keeping balances low, and refraining from taking on unnecessary debt can lead to a gradual improvement in your CIBIL score. Consistency is key, as a long-standing positive repayment history demonstrates financial responsibility.

How Long Will It Take to See Results?

For most individuals, how much time it takes to improve CIBIL score can vary based on their starting score and efforts. If your score is moderately low (600–650), you might see a decent improvement within 6 months if you follow the steps outlined.

For scores below 600, it may take closer to a year to reach a good score above 750. Remember, a consistent and disciplined approach to credit management is essential for sustained improvement.

Tips to Improve Your CIBIL Score Faster

- Set up Payment Reminders: Timely payments are crucial, so set reminders or automate payments.

- Use a Lower Percentage of Your Credit Limit: Keeping your utilization below 30% can accelerate improvement.

- Limit Loan Applications: Apply only when necessary to avoid hard inquiries.

- Monitor Your Credit Report: Check for errors and resolve them quickly.

- Increase Credit Limits: Request higher credit limits but avoid using the full amount, as this can lower your utilization ratio.

Conclusion

Improving your CIBIL score can be achieved with a disciplined approach and time. How much time it takes to improve CIBIL score depends on your specific circumstances and financial habits.

While minor improvements can be seen within a few months, achieving a significant boost often takes 6 to 12 months. The key is to be consistent, avoid financial missteps, and prioritize responsible credit behavior.

Whether you’re aiming for better loan opportunities or financial security, improving your CIBIL score is a worthwhile investment. Start today with small, steady steps, and within a year, you’ll likely see a substantial difference in your CIBIL score.

Read Also: How to Improve CIBIL Score Without Loan: 7 Effective Steps

FAQs on “How Much Time It Takes to Improve CIBIL Score?”

-

How often should I check my CIBIL score?

You should check your CIBIL score at least twice a year. Regular monitoring helps you stay informed about your credit health and detect any errors.

-

What is considered a good CIBIL score in India?

A score above 750 is generally considered good in India and makes you eligible for better loan terms and interest rates.

-

Does having multiple credit cards hurt my CIBIL score?

Not necessarily. As long as you use them responsibly, multiple credit cards can help maintain a good utilization ratio and diversify your credit mix.

-

How can I dispute errors on my CIBIL report?

You can dispute errors by logging in to the TransUnion CIBIL website and submitting a request for correction. Errors are usually resolved within 30-45 days.

-

Will paying off all debts improve my score immediately?

Paying off debts improves your score, but it takes 3-6 months to reflect significantly. Your payment history will gradually have a positive impact.

-

Is it possible to improve my CIBIL score in a month?

While some minor changes may reflect quickly, substantial improvement usually requires consistent good credit practices over a few months.

Read Other Latest Posts Below